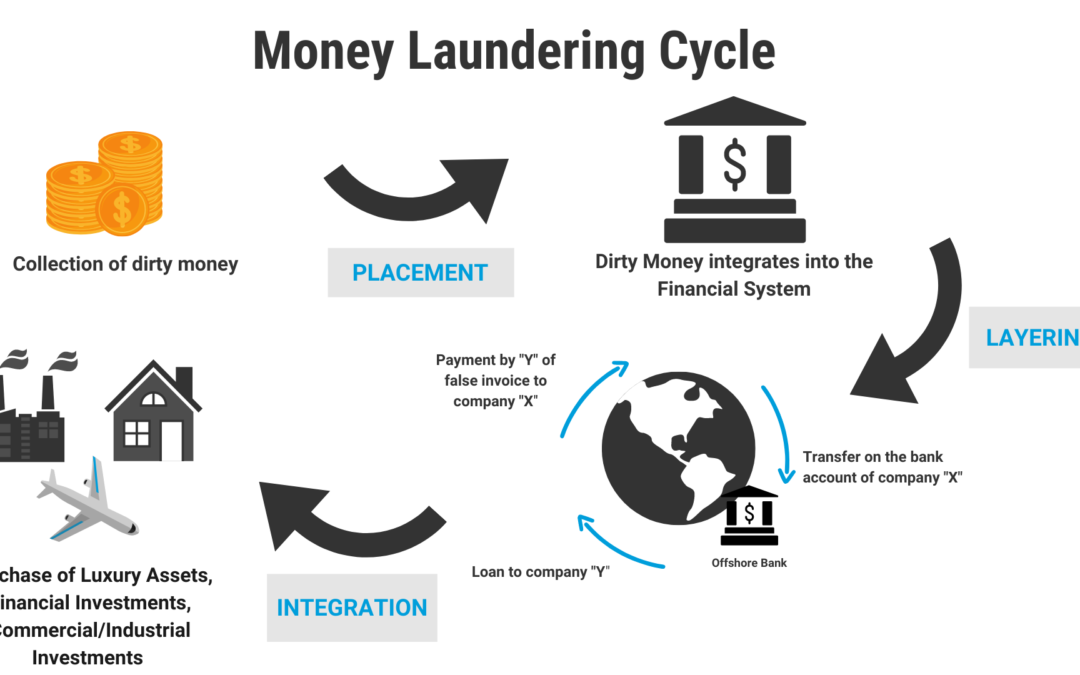

Money laundering is the illegal process of disguising the origins of money obtained through criminal activities, such as drug trafficking, terrorism, corruption, fraud, or other illegal activities, to make it appear as though the money came from legitimate sources. The process typically involves three stages: placement, layering, and integration.

- Placement: Illegally obtained funds are introduced into the financial system. This may involve depositing cash into bank accounts, purchasing high-value assets such as real estate or luxury goods, or engaging in other transactions to convert illicit cash into more easily transferable forms.

- Layering: The launderer conducts a series of complex financial transactions to obscure the trail of the illicit funds. This may involve transferring funds between multiple accounts, countries, or financial institutions, making it difficult for authorities to trace the original source of the money.

- Integration: The laundered funds are reintroduced into the economy in such a way that they appear to have come from legitimate sources. This may involve investing in businesses, purchasing assets, or engaging in other activities that generate legitimate income, effectively “integrating” the illicit funds into the legitimate economy.

Money laundering is prohibited and considered a serious crime for several reasons:

- Facilitating Criminal Activities: Money laundering enables criminals to profit from their illegal activities and perpetuate further criminal conduct, such as drug trafficking, terrorism, human trafficking, and corruption. By disguising the origins of illicit funds, money launderers help criminal organizations avoid detection and prosecution.

- Undermining Financial Integrity: Money laundering undermines the integrity of the financial system by introducing illicit funds into legitimate channels. This can distort economic activities, distort market prices, and erode public trust in financial institutions. It also creates vulnerabilities for exploitation by organized crime groups and terrorist organizations.

- Funding Terrorism: Money laundering can be used to finance terrorist activities by providing a means to disguise the sources of funding and transfer funds across borders without detection. Terrorist organizations rely on laundered funds to finance their operations, recruit members, and carry out attacks.

- Threatening National Security: Money laundering poses significant risks to national security by enabling illicit actors to conceal their activities, evade law enforcement, and undermine government efforts to combat crime and terrorism. Laundered funds can be used to finance political corruption, destabilize economies, and undermine democratic institutions.

To combat money laundering, governments around the world have implemented laws and regulations requiring financial institutions, businesses, and individuals to implement anti-money laundering (AML) measures, such as customer due diligence, transaction monitoring, reporting suspicious activities, and implementing internal controls to detect and prevent money laundering activities. Violations of AML laws can result in severe penalties, including fines, imprisonment, and asset forfeiture.